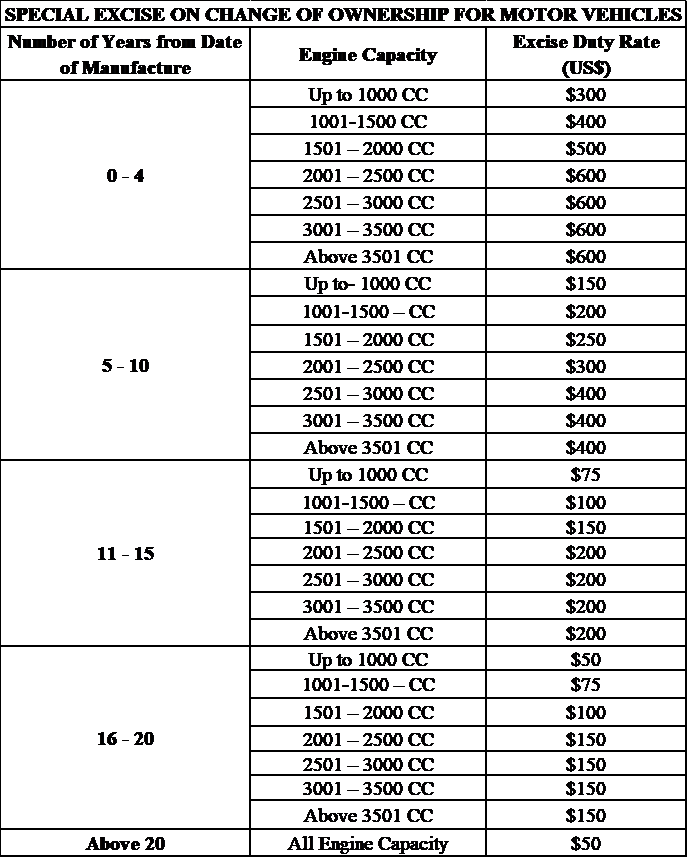

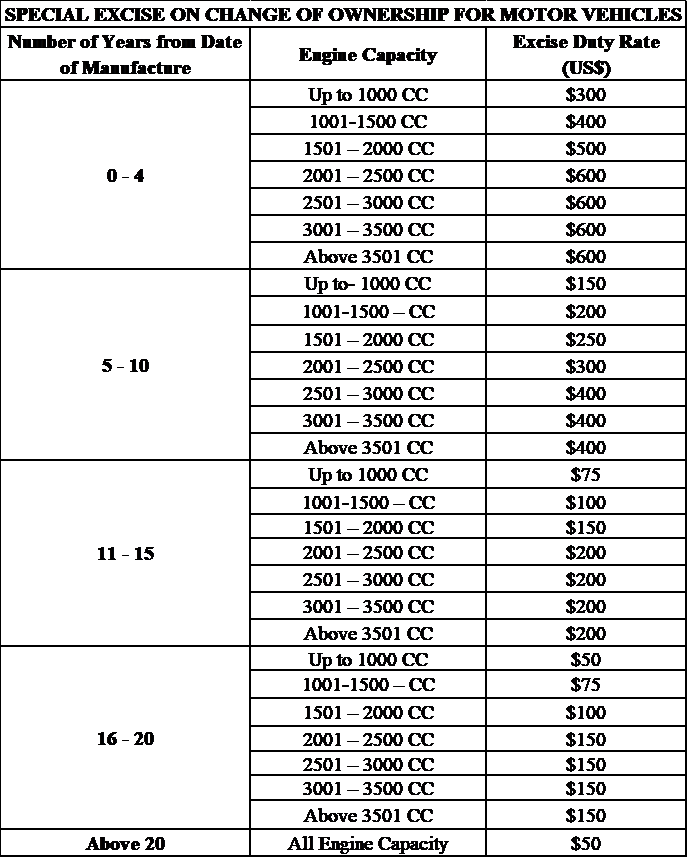

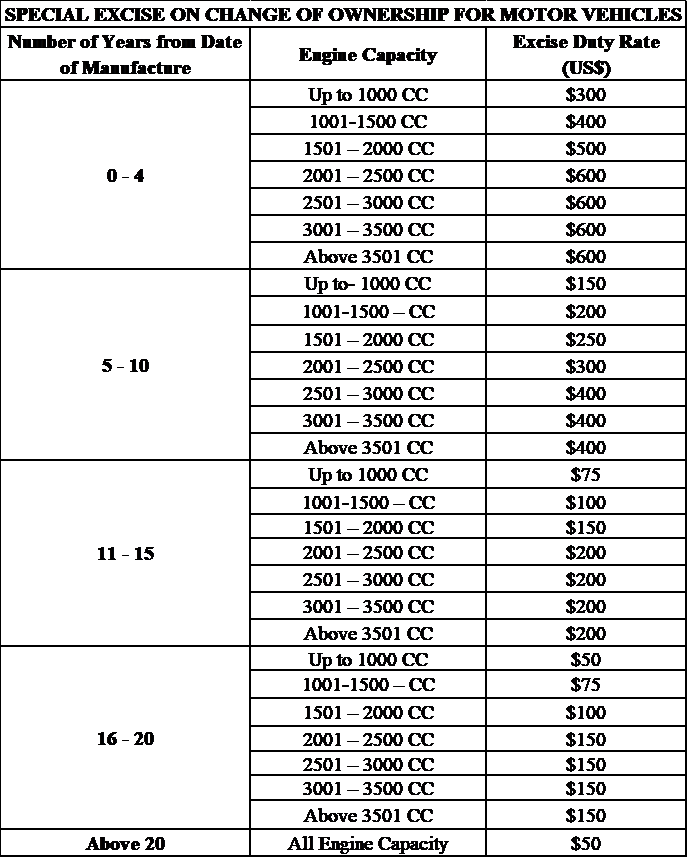

The amounts of excise duty due on change of ownership of second hand motor vehicles is payable in United States dollars unless if the transaction is concluded in Zimbabwe dollars, wherein, the equivalent amounts in Zimbabwe dollars shall be applied at the prevailing exchange rate on the day of payment. The applicable excise duty amounts are as per the table below: -

|

Disclaimer

This article was compiled by the Zimbabwe Revenue Authority for information purposes only. ZIMRA shall not accept responsibility for loss or damage arising from use of material in this article and no liability will attach to the Zimbabwe Revenue Authority, (ZIMRA).