Charging Surcharge on Motor Vehicles of an FOB Value Of US$120,000 and above

With effect from 1 June 2023, a surcharge of thirty percent (30%) shall apply on motor vehicles of an FOB value of USD 120, 000.00 and above? It an additional tax charged over and above the normal duty and tax ordinarily charged on the specified motor vehicles listed below.

Which vehicles are affected by this surcharge?

The 30% surcharge shall apply to motor vehicles of commodity codes listed below

- The whole of heading 8703 which includes:

- Passenger type motor vehicles commonly known as saloon cars, sedans, hatchbacks, station wagons and the like.

- Ambulances and hearses

- All double cabs and extended cab vehicles classified as follows:

- 8704.21.20 Double Cabs

- 8704.31.20 Double Cabs

- 8704.21.50 Extended Cabs

- 8704.31.50 Extended Cabs

- 8704.41.20 Double Cabs

- 8704.41.50 Extended Cabs

- 8704.51.20 Double Cabs

- 8704.51.50 Extended Cabs

Exclusions

The following importations will not be subjected to the 30% surcharge

- Vehicles procured by the government

- Vehicles of a commercial nature for example buses, minibuses, trucks, road tractor units, and the like

- Single cab vehicles and panel vans

Disclaimer

This article was compiled by the Zimbabwe Revenue Authority (ZIMRA) for information purposes only. ZIMRA shall not accept responsibility for loss or damage arising from use of material in this article and no liability will attach to the Zimbabwe Revenue Authority.

Authorized Economic Operator (AEO) Programme

Customs – Business Relationship

In line with international best practice and the Customs and Excise Act [Chapter 23:02] section 216B, Zimbabwe has implemented the Authorized Economic Operator (AEO) programme.

- Authorized Economic Operator (AEO)

- AEO is a programme under the World Customs Organization (WCO) SAFE Framework of Standards to secure and enhance international supply chain security and facilitate movement of legitimate goods across international borders.

- An AEO may defined as a party involved in the international movement of goods in whatever function that has been approved by or on behalf of a national Customs Administration as complying with WCO or equivalent supply chain security standards. AEO include inter-alia manufacturers, importers, exporters, brokers, carriers, consolidators, intermediaries, ports, airports, terminal operators, integrated operators, warehouses, distributors. The facility is open to all stakeholders in this supply chain.

- ZIMRA AEO Programme

- Administered by Customs and Excise Division, the AEO Programme is a voluntary programme open to all business entities that participate in the global supply chain.

- Business entities that meet pre-determined compliance standards are accredited as AEOs and as such enjoy appropriate facilitation on Customs clearance.

- Benefits of AEO Programme

- Faster movement of cargo through the Border/Port of entry

- Simplified Customs formalities

- Fewer physical and document-based controls

- Reduced demurrage and other related costs

- Priority treatment in query resolution

- Choice of the place for physical examination

- Facilitation for movement of cargo during periods of trade disruptions

- Improved relations with ZIMRA

- Promotes an AEO accredited entity as a secure and reliable trade partner thereby improving business competitiveness.

- Mutual recognition of AEO authorizations between Customs authorities as a long term benefit.

- Provides businesses with internationally recognized security standards.

- The opportunity to self-assess allows entity to have a full insight into its operations and business practices, identify and strengthen any security or compliance related weaknesses

- Qualification Criteria

Any entity interested in getting benefits of the AEO programme shall apply in writing to the Commissioner of Customs & Excise for accreditation. The entity must meet the following conditions:

- Be established in Zimbabwe;

- Have appropriate record of compliance with Customs and other relevant laws;

- Have a satisfactory system of managing commercial and, where appropriate, transport records;

- Have proven financial solvency; and

- Ensure that there is general maintenance of approved security and safety standards at both the entity`s place of operations as well as its business systems and procedures.

- AEO Application Process

- Consultation with nearest ZIMRA office on AEO application procedure

- Completion of and submission of self-assessment questionnaire, application form and other relevant attachments required for the granting of AEO status

- Examination of application by ZIMRA

- Onsite inspection by ZIMRA

- AEO authorization

- Obligations of an AEO

The AEO is required to;

- Keep proper records it terms of Section 223 of the Customs & Excise Act [Chapter 23:02].

- Maintain an accounting system which is in accordance with the Generally Accepted Accounting Practices (GAAP) and which facilitates audit based customs control.

- Ensure that its staff members conduct business in accordance with the procedures of the Customs & Excise Act and any other Act administered by ZIMRA or any instructions given by the Commissioner of Customs & Excise.

- Ensure a relationship of good faith is maintained by its staff at all times in dealing with the ZIMRA.

- Allow ZIMRA officers physical and electronic access to the information and documents as provided for in terms of Section 223 of the Customs & Excise Act.

- Use compatible E-Systems for Customs procedures and commit to regularly upgrade the systems.

- Ensure that its premises are in conformity with the appropriate security and safety standards.

My Taxes, My Duties: Building my Zimbabwe!!

Disclaimer

This article was compiled by the Zimbabwe Revenue Authority (ZIMRA) for information purposes only. ZIMRA shall not accept responsibility for loss or damage arising from use of material in this article and no liability will attach to the Zimbabwe Revenue Authority.

General Registration Certificate Form: Personal Effects and Goods for Repair and Return

Certain goods can be temporarily exported and not pay duty on their return due to their nature and purpose of export. These are personal items that are carried on a travellers person that qualify for such a reprieve in Customs that are for personal consumption. There are many cases where travellers indicate that they had temporarily exported their valuable personal effects but do not have proof that they did so. In this instance, they would not be carrying any documents to support their plea. This has resulted in many disputes among travellers and officers.

Let us explore a summary of instances and goods that can be temporarily exported and not pay duty on their return.

Personal effects

Used clothing and toilet requisites should be in such quantities and of such values as the Commissioner may consider being reasonable. Articles like radios, binoculars, laptops and cameras should be registered at a Customs House or Port of exit before exportation. The said articles shall be brought before the officer registering them, for inspection. The articles shall only be registered if they can be accurately described and are capable of being identified (have serial numbers) on their return. If the articles meet the above conditions, the officer will issue traveller with a General Registration Certificate with the full details of the article including serial numbers and his/her personal details. This certificate should then be produced on return as proof of temporary export so that no duty will be charged on that article.

Goods for Repair and Return

When goods are exported for repair and return, only the cost of repairs will be subject to duty. The tariff heading to be applied is that under which the repaired article, as re-imported would be classified. For instance, duty rates levied on the cost of repairing a television set are those applicable on an imported television set.

Where the repair was done in terms of a valid guarantee and no charge is raised for the repair, no duty will be levied on re-importation of such an article,

General Registration Certificate and Declaration Form

It is very important to declare your personal effects which you are temporarily exporting so as to avoid inconveniences on re-entry or challenges with officers at the port of exit. A General Registration Certificate is used for this purposes and in cases where such forms are scarce, a Declaration Form 47 processed by the officer at a Customs House or port of exit can also serve the same purpose. The form should clearly indicate goods temporarily exported and/or for re-importation.

My Taxes, My Duties: Building my Zimbabwe!!

Disclaimer

This article was compiled by the Zimbabwe Revenue Authority (ZIMRA) for information purposes only. ZIMRA shall not accept responsibility for loss or damage arising from use of material in this article and no liability will attach to the Zimbabwe Revenue Authority.

To contact ZIMRA:

www. zimra.co.zw@Zimra_11

ZIMRA.ZW

Contact Centre 585/ 08688007614

This email address is being protected from spambots. You need JavaScript enabled to view it.

0242 –758891/5; 790813; 790814; 781345; 751624; 752731

+263 0782729862

e-TIP http://ecustoms.zimra.co.zw/etip

Transfer of specified assets between spouses

In terms of section 16 of the Capital Gains Tax Act [ CHAPTER 23:01], Capital Gains Tax (CGT) is deferred where any specified asset is transferred between spouses or a principal private residence is transferred to a former spouse in compliance to a court directive. The transferor and the transferee may elect that the sale price be deemed equal to the deductions allowable such that in the hands of the transferor nothing will be taxable.

What are the requirements for deferring CGT upon transfer of specified assets between spouses?

An election has to be made at the time the person making the election is submitting the CGT return for the assessment of his capital gain.

What are the conditions of deferring CGT?

The concession is limited to where:

(a) the ownership of any specified asset is transferred from a person to his or her spouse; or

(b) a person transfers the ownership of a specified asset which is his principal private residence to his former spouse in compliance with an order of a court providing for the maintenance of the former spouse or dividing, apportioning or distributing the assets of the former spouses on or after the dissolution of their marriage.

In what circumstances does the deferred CGT become due?

In the event that the specified asset is subsequently sold to another party, capital gain or assessed capital loss in the hands of the seller shall be calculated as if the asset is still owned by the first transferring spouse.

My Taxes, My Duties: Building my Zimbabwe!!

Disclaimer

This article was compiled by the Zimbabwe Revenue Authority (ZIMRA) for information purposes only. ZIMRA shall not accept responsibility for loss or damage arising from use of material in this article and no liability will attach to the Zimbabwe Revenue Authority.

ZIMRA Introducing a Contact Centre

Q: What is the new ZIMRA initiative being introduced?

A: The Zimbabwe Revenue Authority (ZIMRA) is leveraging ZIMRA to excellence in service by introducing a high quality, cost effective, interactive communication channel between ZIMRA and its valued clients in tandem with set statutory obligations. ZIMRA is introducing a Contact Centre, which is expected to improve service delivery by opening up communication channels between the Authority and its clients.

Q: What is a Contact Centre

A single point of contact for all communication where queries, enquiries and feedback may be channeled and handled through various client touch points like social media, email, calls, mail, SMS among others.

Q: Why has the Contact Centre been introduced now?

A: The revenue collector has decided to add the contact centre to its already existing communication channels as part of its much wider Business Process Re-engineering (BPR), which is looking at reinvigorating and introducing improved processes.

Most of the BPR processes that have been revamped or reviewed have typically come with technological solutions. The contact centre project has been the result of wide consultations internally and externally to ensure that the system adheres to international best practice. ZIMRA has deliberately put Customer Centricity as its core focus in recent months and the contact centre adds to the already existing effort to improve service.

Q: What is the Contact Centre’s promise?

A: Get in touch with our vibrant Contact Centre team and we promise to serve you through fast responses, ensuring resolution of your queries in a courteous manner.

Q: What are the Contact Centre Operational times?

A: Currently the Contact Centre is operating between 8am-5pm with agents attending to customer queries.

Q: How can I access the contact Centre?

A: Contact Centre phone number: 08688007614

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

My Taxes, My Duties: Building my Zimbabwe!!

Disclaimer

This article was compiled by the Zimbabwe Revenue Authority (ZIMRA) for information purposes only. ZIMRA shall not accept responsibility for loss or damage arising from use of material in this article and no liability will attach to the Zimbabwe Revenue Authority.

Mentally or physically disabled persons tax credit

What is a mentally or physically disabled person’s tax credit?

It is a specified amount deducted from the income tax, which a taxpayer is chargeable, where it is proved to the satisfaction of the Commissioner that the taxpayer is mentally or physically disabled to a substantial degree, but is not blind. The tax credit has an effect of reducing the tax liability of a taxpayer.

Who qualifies for the credit?

A qualifying individual taxpayer or taxpayer’s child who is proved to the satisfaction of the Commissioner to be mentally or physically disabled to a substantial degree. A taxpayer can also claim the credit for his /her child who is blind.

What are the conditions to be fulfilled?

- The taxpayer should be ordinarily resident in Zimbabwe at any time in the period of assessment.

- The employee should get a letter from a specialist medical doctor, stating the nature and degree of disability and apply for a written directive from their nearest ZIMRA office.

- A person shall be regarded as being mentally or physically disabled if his disability is not of a temporary or transitional nature.

Can the tax credit be apportioned?

- No, the tax credit cannot be apportioned.

Is the tax credit transferable between spouses?

- Yes, the tax credit can be transferred between spouses.

- Any portion of a credit deductible in terms of subsection (1) or (2) which is not applied in reduction of the income tax with which a married person is chargeable shall be allowed as a deduction from the income tax with which his or her spouse is chargeable.

How much is the credit?

- The specified amount of credit to be deducted from the income tax payable by a qualifying taxpayer is $ USD 900 or 450 000ZWL per each year of assessment.

Suspension of duty on public service buses imported by approved importers: SI 138 of 2022

What are Approved importers?

An “approved importer” means a public bus operator duly registered in terms of Part III of the Road Motor Transportation Act [Chapter 13:15].

A “public service bus” means new buses of commodity code 8702.10.11 and 8702.90.11 being imported or removed from bond by an approved importer.

Conditions for approved importers to qualify for the facility are as follows

- An approved importer shall be allowed to import not more than twenty (20) public service buses in any twelve-month period beginning 1st July 2022.

- Proof that the approved importer is duly registered in terms of Part III of the Road Motor Transportation Act [Chapter 13:15];

- Written authority from the Secretary for Transport and Infrastructural Development indicating the name of the approved importer, as well as the make, model, engine and chassis number of the public service bus to be imported.

- proof of satisfaction of the requirements of sections 37, 37A, 42 and 61 of the Income Tax Act [Chapter 23:06], a valid tax clearance certificate, proof of payment of any income tax due , payable for the previous fiscal year, and certified thereof by the Commissioner responsible for the administration of the Income Tax Act.

My Taxes, My Duties: Building my Zimbabwe!!

Disclaimer

This article was compiled by the Zimbabwe Revenue Authority (ZIMRA) for information purposes only. ZIMRA shall not accept responsibility for loss or damage arising from use of material in this article and no liability will attach to the Zimbabwe Revenue Authority.

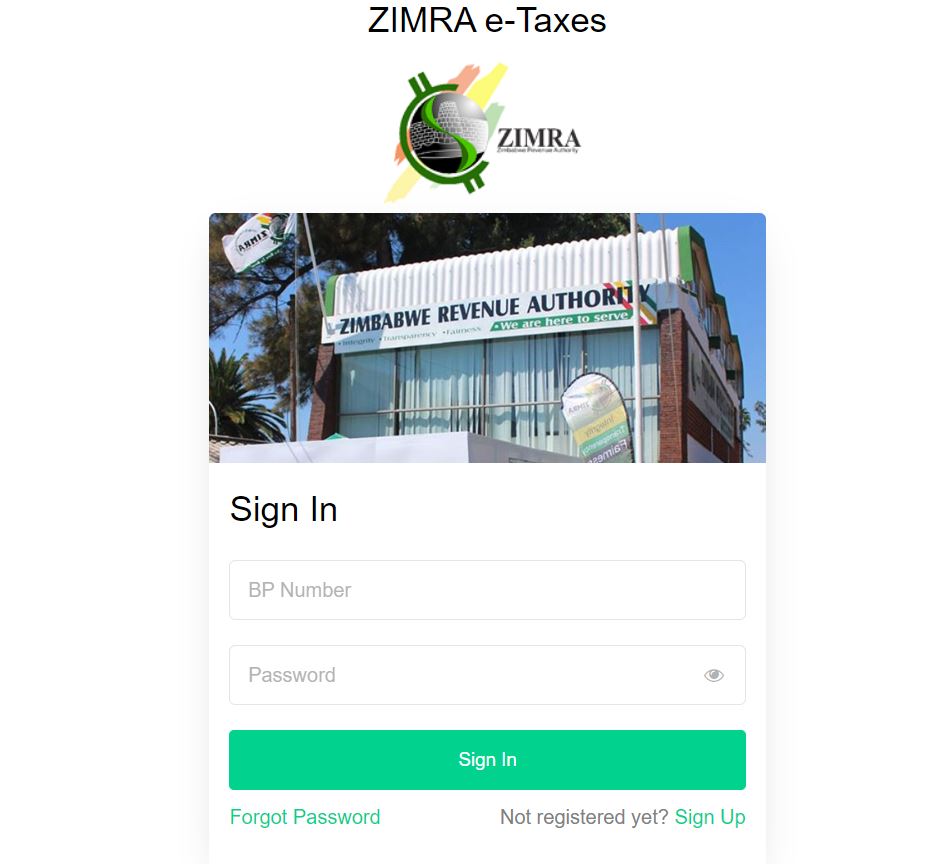

E-TAXES Online platform

In an effort to reduce the compliance costs associated with submission of returns and as a mitigating measure against technical challenges being faced by taxpayers, especially with the E-Services online filing platform, the Authority has launched another online filing platform called E- Taxes. E-Taxes is similar to E-services but with minor differences on the registrations process and functions.

What are the functions of E-Taxes?

- Submission of Returns

- Viewing Returns Submitted

- Viewing Compliance Status

What is the registration process for E-Taxes?

- Go to any browser and type the following URL to access the e-Taxes system https://etaxes.zimra.co.zw

- Click on the Sign Up link – at the bottom right corner of the page.

- On the pages that comes up, click the drop down menu/arrow and select” I have a BP number”. The assumption is that you already have a BP number. Write you BP number, starting with a zero and write the email address that is registered with ZIMRA. Click submit.

- Another page comes up which requests information for your profile, like first name, surname, phone number and password. Click Submit.

- Once the details are submitted, an email to activate your account is sent to the email address used to register.

- Log into your email and click on the activation link sent from Customer Services to activate the account. Please note that the activation link expires within the timeframe mentioned in your email.

- After clicking the activation link, a pop up screen comes up which indicates whether or not the activation was successful. Click on “Go to Login Page” link to access the login page. Log into E-Taxes using BP number and email address used to register for E-Taxes.

Please note that the entire sign up process is a once-off process. Once the process is completed, every other time you will just login and use the system to make your submissions. Moreover, even if the taxpayer has both the ZWL BP and the FOREX BP, registration for E-Taxes is done once with one BP (ZWL BP) and the same E-Taxes account registered can be used to file returns for both BPs. The taxpayer just has to pick the currency that relates to the type of BP for which the return is being submitted.

How do you submit returns on E-Taxes?

- Click on the tab or link labelled Submit Tax Returns and select the appropriate tax head for which you need to make a submission.

- Select and click on the tax head for which you intend to make a submission for.

- Drop down on currency and pick currency that relates to/is appropriate depending on the BP for which the return is being submitted. Fill in the appropriate fields and complete the submission of the return by clicking the submit button. Once a notification that the submission was successful comes out, there is no need to re-submit the return again.

How do you view submitted returns?

- Click on the tab or link labelled Tax Submission History

- Select the return to be viewed

- Click view and the return captured is displayed.

How do you check compliance status (outstanding issues)?

Click on the tab or link labelled Tax Clearance Certificate and click on Tax Clearance icon to view the taxpayer’s status

Please note that one cannot apply for a Tax Clearance on the E-Taxes platform.

My Taxes, My Duties: Building my Zimbabwe!!

Disclaimer

This article was compiled by the Zimbabwe Revenue Authority (ZIMRA) for information purposes only. ZIMRA shall not accept responsibility for loss or damage arising from use of material in this article and no liability will attach to the Zimbabwe Revenue Authority.

To contact ZIMRA:

www. zimra.co.zw@Zimra_1

ZIMRA.ZW

This email address is being protected from spambots. You need JavaScript enabled to view it./webmaster@zimra.co.zw

0242 –758891/5; 790813; 790814; 781345; 751624; 752731

+263 0782729862

e-TIP http://ecustoms.zimra.co.zw/etip