Acting CG urges staff members to embrace integrity

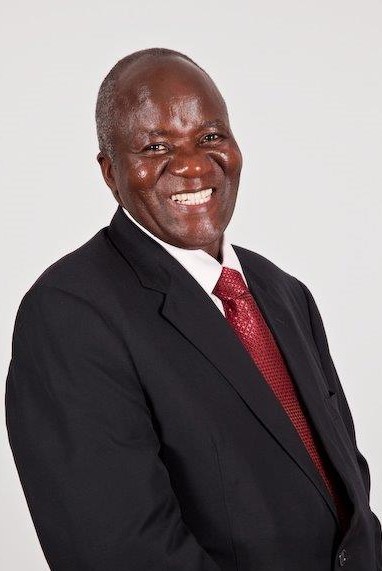

Acting Commissioner General, Mr Rameck Masaire, on his visit to Marondera, Rusape, Mutare and Forbes Border Post on 22 April 2021, urged staff members to embrace integrity, a thrust being promoted by the Loss Control Division.

The Acting CG called upon ZIMRA Officials to align their conduct with professionalism and to uphold ethical standards and do the right thing regardless of their circumstances.

“We need to identify Loss Control with the positive elements and sanity it brings to the entire organisation. The Division was never setup with the intention of arresting officers or initiating dismissal of officers. The Division was setup primarily to minimise loss of ZIMRA property and that includes the human resources,” said Mr Rameck Masaire.

Loss Control Director, Mr Tapiwa Manyika, also raised concerns on the number of officers that the Authority is losing due to integrity breaches. He highlighted that it is not ideal that the Authority continues to lose officers on account of corruption given the amount of resources that would have been invested in training the officers.

“The continued dismissal of officers due to corruption is an indication that there is a loop hole in the system and my division will devise strategies to ensure that we protect our staff. I urge you to be your brother’s keeper and remind colleagues to desist from falling into the corruption temptation,” said Mr Tapiwa Manyika.

Present at the visits were Executive Management members undertaking an exercise to familiarise themselves with the Marondera, Rusape, Forbes and Mutare offices as well as reassuring staff members of the importance of the four Ps strategy.