The Zimbabwe Revenue Authority (ZIMRA) prides itself on having a Board that has a pro-growth team of professionals at the strategic layer. The Board is driving the change agenda with precision and passion to mould a ZIMRA that is synonymous with efficiency and effectiveness, anchored on digital solutions and superior human capital.

The ZIMRA Board is led by the Board Chairman Mr. Antony Mandiwanza, an astute transformational leader who has over 30 years of traceable industry and corporate leadership. One of his many accolades is leading the privatisation of a publicly owned company into a vibrant entity that is now listed on the Zimbabwe Stock Exchange.

The Board Chairman is deputised by Mrs. Josephine Matambo, an expert in the tax and audit field with an illustrious career spanning over four decades. She started her career in the then Department of Taxes. Mrs. Matambo brings a wealth of experience regarding the operations of tax administration. She is a member of the Audit and ICT Committees.

Mr. George Guvamatanga is the Permanent Secretary of the Ministry of Finance and Economic Development, and an ex-officio member of the Board. The “Perm Sec”, as he is affectionately known, is a career banker with over 30 years of Banking experience specialising in Treasury and Corporate and Investment Banking. He is a member of the ZIMRA Operations and Audit Committees.

Mr. Memory Nguwi is a Registered Occupational Psychologist who brings on board critical human capital management expertise. Mr. Nguwi is the Chairman of the ZIMRA Human Resources Committee and also a member of the ZIMRA Finance and Administration Committee.

Mr. Isaac Kwesu has vast experience in research, economics, strategy, and policy analysis spanning over 15 years. He has lectured at various institutions in economics, corporate and public finance and is credited for his crucial input on indigenisation and mining policies. He is the Chairman of the Audit Committee and a member of the Risk Committee.

Ms. Mutsa Remba is a registered Legal Practitioner, with over 16 years of experience in private practice. Her experience spans across commercial law, mining law, and financial services. She is the Chairperson of the Operations Committee and also a member of the Human Resources Committee.

Mrs. Ruth Ncube is a versatile business leader with a distinguished record of implementing winning strategies and delivering business results. Mrs. Ncube is a winner of multiple prestigious honours awards in leadership, and in the Insurance sectors nationally and abroad. She is the Chairperson of the Risk Committee and also a member of the Finance and Administration and Human Resources Committees.

Dr. Paradza Paradza is a seasoned Information and Communication (ICT) expert and governance professional with more than 20 years of international and domestic experience in managing ICT projects in the banking, manufacturing, mining, telecommunications, and education sectors. Dr. Paradza is the Chairman of the ICT Committee and also a member of the Risk and Operations Committees.

Dr. Grace Muradzikwa is a decorated insurance executive with over 37 years in the industry. She was the first woman to list and head a publicly traded company in the country, a position she held until 2019. She is currently the Commissioner of Insurance, Pension and Provident Funds in Zimbabwe. Through her dedication and hard work, Dr. Muradzikwa has won several awards and served on various boards of local, regional and international institutions. She is the Chairperson of the Finance and Administration Committee and also a member of the Risk and Human Resources Committees.

Mr. Bongani Khumalo is a versatile economist with vast experience in the private and public sectors. He is an expert in the areas of fiscal policy research, economic analysis, and public finance. He served as a lecturer at the University of Zimbabwe, Rhodes University, and Witwatersrand University in the areas of Economics Principles, Trade Policy, Public Finance, and International Economics. He served at the Financial and Fiscal Commission in South Africa for 17 years including 8 years of which he served as Chairman and Chief Executive Officer. He is a member of the ICT and Finance and Administration Committees.

Mr. John Tandi Dewah is a veteran in public administration having served in Government for several years and rose to the rank of Chief Director. He brings a unique and invaluable perspective of public finance grounded in years of experience gleaned from government services, public entities and regional exposure. He is a member of the ICT and Audit Committees.

Ms. Regina Chinamasa is an ex-officio member of the ZIMRA Board. She is a thoroughbred tax administrator having started her career in 1994 in the then-Department of Taxes. She rose through the ranks to the position of ZIMRA Commissioner General. She is a pro-action leader who subscribes to modernisation of processes for efficiency and effective service delivery. She is driving and inculcating a culture of execution within the Authority.

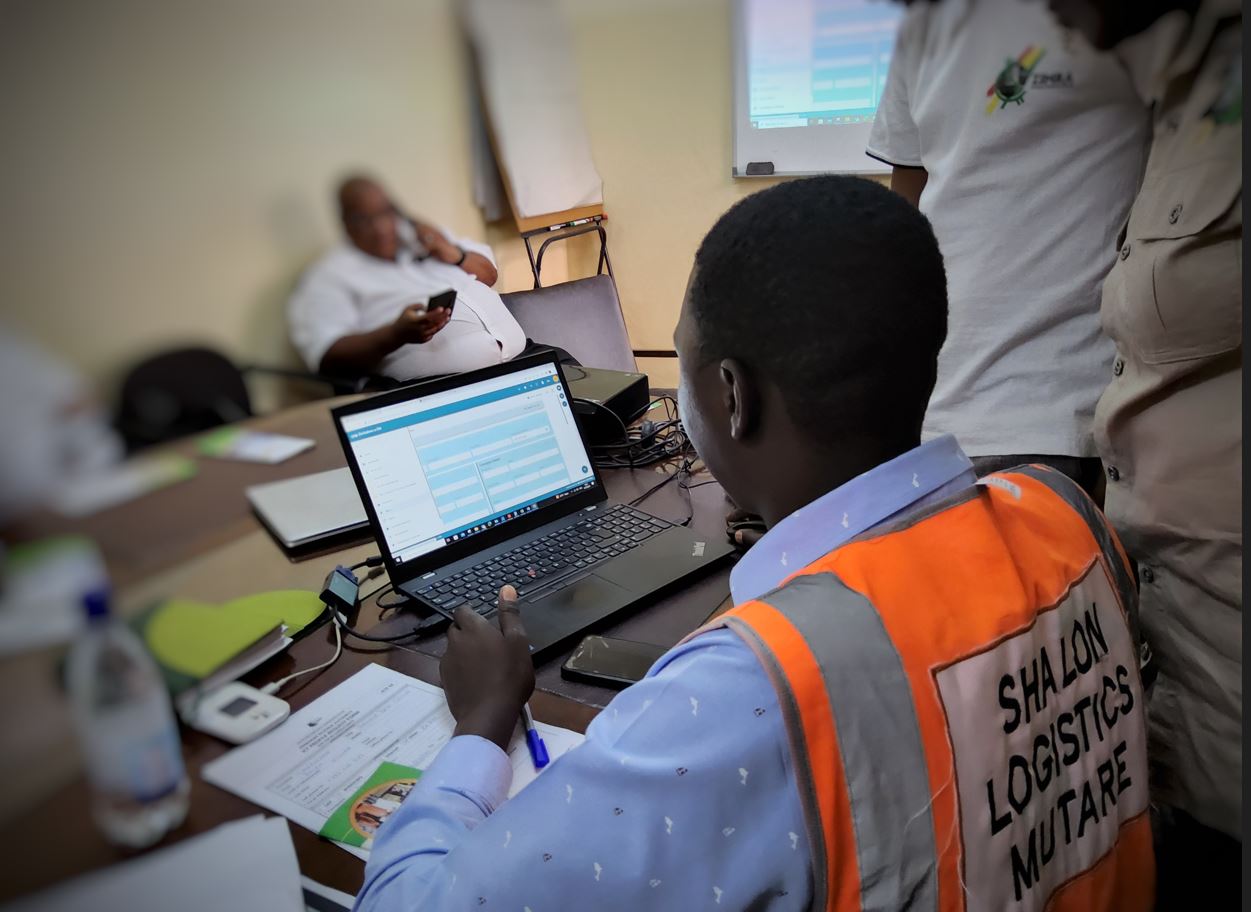

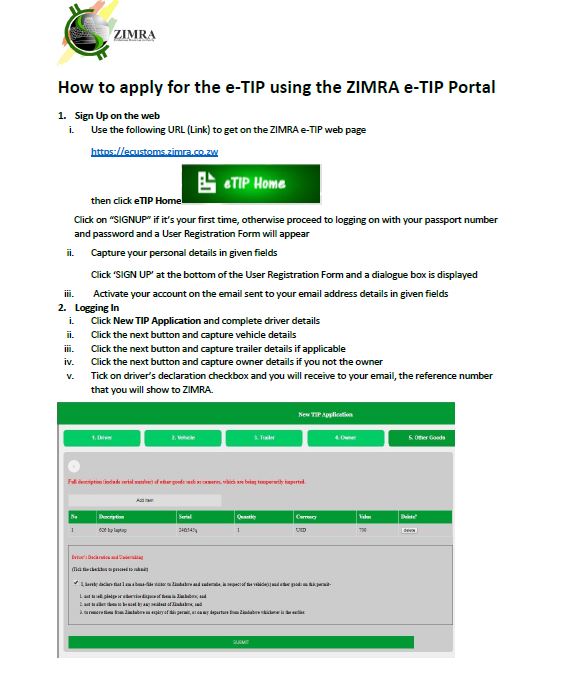

We're thrilled to witness the first-ever transaction taking place, and it's truly a historic moment for our nation's trade industry.

We're thrilled to witness the first-ever transaction taking place, and it's truly a historic moment for our nation's trade industry.

The days of cumbersome paperwork and lengthy procedures are behind us as we embrace the era of efficient and streamlined trade operations.

The days of cumbersome paperwork and lengthy procedures are behind us as we embrace the era of efficient and streamlined trade operations.

Our commitment to embracing digital innovation is shaping the future of trade in Zimbabwe and opening doors to endless possibilities.

Our commitment to embracing digital innovation is shaping the future of trade in Zimbabwe and opening doors to endless possibilities.

Let's embrace the power of technology and unlock new horizons in trade facilitation and economic growth.

Let's embrace the power of technology and unlock new horizons in trade facilitation and economic growth.